The market rollercoaster has taken Nike’s NKE and Lululemon’s LULU stock for a wild ride. Despite surpassing quarterly revenue and profit forecasts, both companies witnessed a decline in shares following softer guidance.

Investors are now left pondering whether it’s the opportune moment to swoop in and snag these retail giants, especially with Nike’s stock down by 13% year to date and Lululemon dropping 20%.

Image Source: Zacks Investment Research

Analyzing Strong Quarterly Performances

In their latest earnings reports, Nike delivered an earnings per share of $0.98, up 24% from the previous year, beating Q3 expectations by an impressive 42%. Their quarterly sales stood at $12.42 billion, slightly above last year’s figures and beating estimates by 1%. On the other hand, Lululemon reported earnings of $5.29 per share in Q4, a 20% increase from the comparable quarter, and exceeded estimates by 5%. Their Q4 sales of $3.2 billion also surpassed expectations.

Image Source: Zacks Investment Research

Despite these impressive numbers, softer sales forecasts loom over these retail giants.

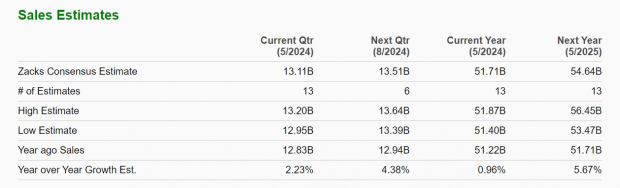

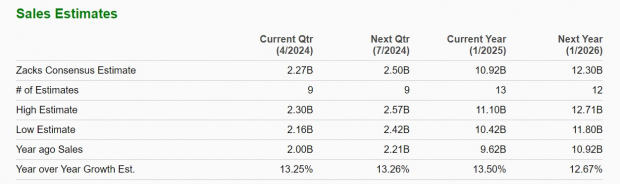

Impact of Weaker Sales Guidance

Nike’s outlook includes a 1% sales increase for fiscal 2024, aligning closely with Zacks estimates. However, the brand anticipates a revenue dip in the first half of FY25 due to product portfolio innovations in a subdued economic environment. Similarly, Lululemon cited sluggish consumer demand for its softer guidance for the upcoming fiscal quarter, with sales expectations slightly lower than Zacks estimates.

Image Source: Zacks Investment Research

While both companies maintain a Zacks Rank #3 (Hold), indicating potential in the long run, short-term challenges could alter their growth trajectories.

Image Source: Zacks Investment Research

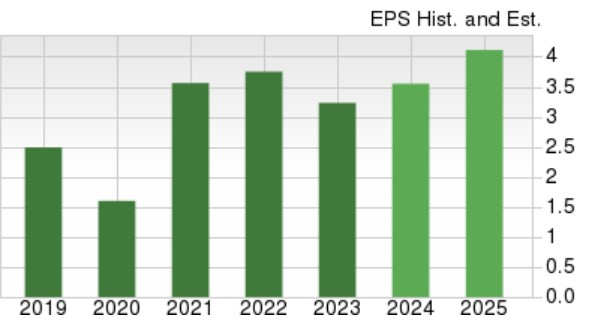

Evaluating Future Earnings Projections

Nike anticipates a 9% rise in EPS for FY24, with further growth expected in FY25. Lululemon, on the other hand, offered guidance for upcoming quarters with optimistic but slightly conservative EPS projections for FY25 and FY26 respectively.

Image Source: Zacks Investment Research

In Conclusion

While Nike and Lululemon navigate through uncertain terrains in achieving their growth targets, their current stock status reflects a story of potential amid turbulence. Investors eyeing a stake in these industry giants should tread cautiously, as short-term market ripples could sway their fortunes.