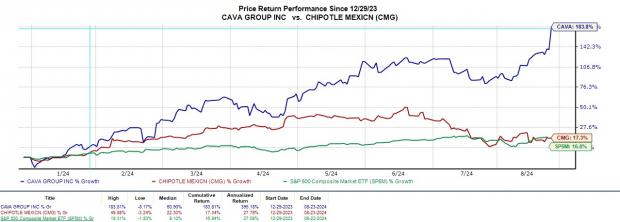

What could be more appetizing than the stock market? Perhaps the sizzle of Cava Group, a company whose stock performance could rival the legendary Chipotle Mexican Grill. Since its tantalizing IPO last year, Cava Group’s shares have been a feast for investors’ appetites.

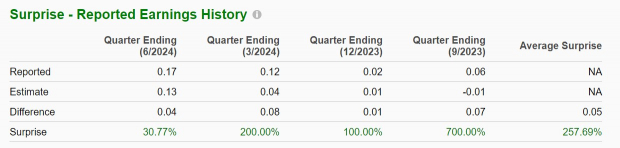

Following its recent Q2 earnings report, Cava Group’s stock soared to new heights, outshining expectations both in revenue and profit. The 35% surge in Q2 sales from the previous year showcased the company’s ability to outperform itself, a track record that has become somewhat of a signature for Cava Group.

With a bold +183% year-to-date leap, CAVA’s stock price dance has left the broader market and even Chipotle in the dust. An impressive feat that has not gone unnoticed.

Image Source: Zacks Investment Research

Cava Group’s Q2 Resilience

The financial prowess displayed in their Q2 results has solidified Cava Group’s standing in the market. With sales hitting $233.5 million, a number that not only surpassed estimates but also showcased a 35% jump from the previous year, it’s evident that CAVA is not a company to be trifled with.

Despite a slight dip in EPS from last year, Cava Group has managed to excel in its market expansion, welcoming new restaurants with open arms, including a bold Midwest market entry in Chicago. A testament to their growth trajectory manifesting right before our eyes.

Image Source: Zacks Investment Research

Cava Group’s Promising Future

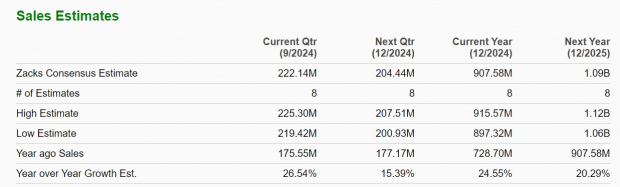

Looking ahead to the future of Cava Group, the figures shine even brighter. Projected sales for fiscal 2024 indicate a hearty 24% climb, with a further 20% expansion in FY25. A clear indicator that CAVA’s growth engine is firing on all cylinders.

Moreover, earnings are forecasted to take flight, with a staggering 66% surge expected in the near term, followed by an additional 34% increase in FY25. An enticing proposition for investors seeking a delectable addition to their portfolio.

Image Source: Zacks Investment Research

The Flavor of Cava Group’s Valuation

While the growth story of Cava Group reads like a tantalizing menu, its valuation might divide investors. Trading at a premium of 291.3X forward earnings, CAVA stands as a testament to its recent IPO success. Yet, a noticeable sales premium to the broader market raises eyebrows, suggesting that CAVA’s price might be a bit too spicy for some.

Image Source: Zacks Investment Research

Final Verdict

While Cava Group’s Q2 revelation cements its standing as a market heavyweight, the stock’s current Zacks Rank #3 (Hold) leaves some room for caution. CAVA presents itself as a flavorful long-term investment, yet the question lingers: Is now the prime time to indulge, or should investors wait for a more opportune buying spree?