Big tobacco producers, Altria Group MO and Philip Morris International (PM), have witnessed a remarkable surge in their stock prices, soaring over +30% this year. Investors are taking note of these stocks due to their attractive dividends and proximity to 52-week highs. But is now the opportune moment to buy shares of these tobacco giants for even higher returns?

Image Source: Zacks Investment Research

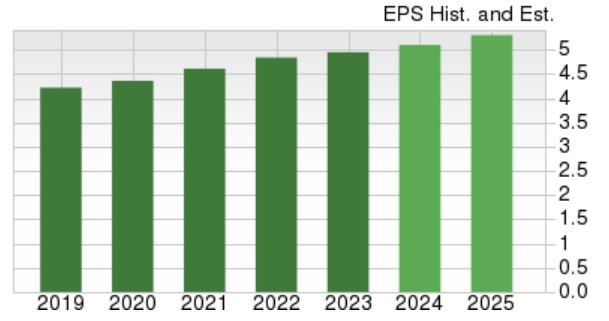

Positive Shift in Profitability

The market landscape for Philip Morris and Altria is evolving with the adoption of smoke-free products driving their growth particularly in international markets like Europe. This strategic move towards heated non-burn tobacco, vapor, and oral nicotine products is not only expanding their footprint but also enhancing their profitability. It’s worth noting that the Zacks Tobacco Industry is currently positioned in the top 10% of over 250 Zacks industries.

According to Zacks estimates, Altria’s projected annual earnings are anticipated to increase by 3% in fiscal 2024 and a further 4% in FY25 to reach $5.30 per share. These figures signify a substantial 25% growth from pre-pandemic levels, with Altria’s earnings standing at $4.22 per share in 2019.

Image Source: Zacks Investment Research

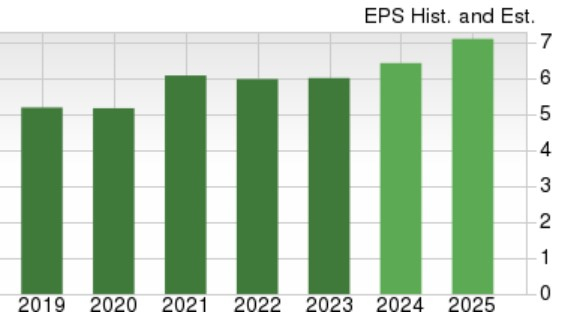

Growth Prospect for Philip Morris

On the other hand, Philip Morris is expected to witness a 7% expansion in its bottom line this year, with annual earnings predicted to grow by 10% in FY25, reaching $7.10 per share. Even more enticing, the estimated EPS projections for FY25 indicate a substantial 37% growth post-pandemic, with earnings per share at $5.19 in 2019.

Image Source: Zacks Investment Research

Valuation Comparison

Currently, Altria’s stock is trading around $54 at a forward earnings multiple of 10.6X, slightly below the industry average of 12.7X. In comparison, Philip Morris shares are priced at $125, with a 19.5X forward earnings multiple, which represents a premium over the industry mean but falls below S&P 500’s 23.2X.

Image Source: Zacks Investment Research

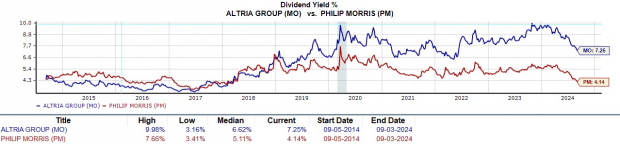

Attraction of Lucrative Dividends

The substantial dividends offered by these major tobacco corporations continue to captivate investors, especially considering the strong earnings outlook for Philip Morris and Altria.

While Philip Morris currently leads in bottom-line expansion, Altria’s annual dividend yield of 7.25% coupled with its more attractive valuation makes it an appealing choice. Notably, Altria is recognized as a Dividend King, having raised its dividend for over 50 consecutive years.

Image Source: Zacks Investment Research

Final Thoughts

With a more promising earnings outlook, Philip Morris International’s stock holds a Zacks Rank #2 (Buy) while Altria Group lands a Zacks Rank #3 (Hold).

Although earnings estimate revisions for FY24 favor Philip Morris, both these tobacco stocks present as viable long-term investments due to their enticing dividends and reasonable valuations.