Seizing opportunities in the stock market can feel like chasing fireflies on a summer night: elusive but oh-so-rewarding. The consumer discretionary sector, particularly, offers a glowing chance to pick up undervalued gems lurking in the dark.

One such beacon in this realm is the Relative Strength Index (RSI) which acts as a lighthouse guiding traders through the choppy waters of volatile markets. When the RSI dips below 30, it’s akin to finding buried treasure – a signal that a stock may be oversold and due for a rebound.

Let’s set sail and explore two top contenders flashing on the radar for savvy investors:

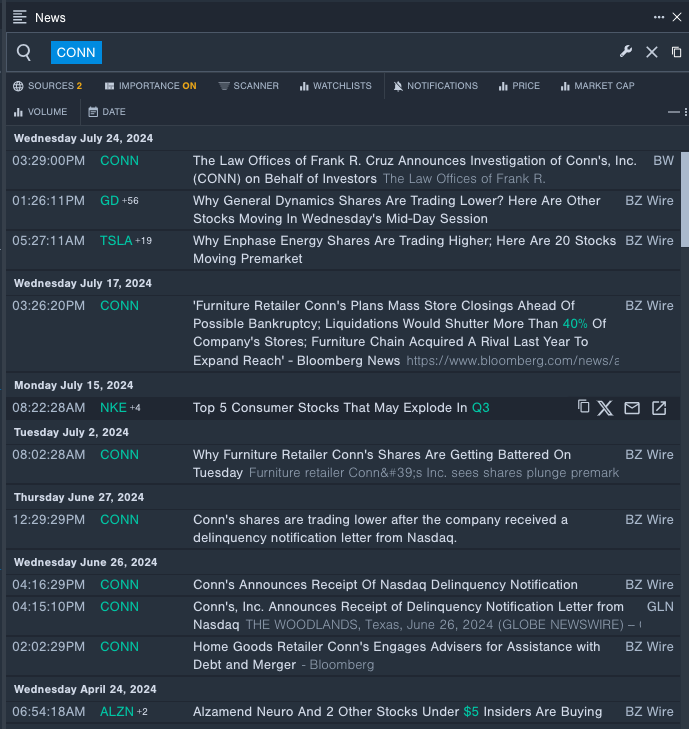

Conn’s Inc CONN

- Conn’s Inc has been weathering some turbulence lately, receiving a delinquency notification letter from the Nasdaq sending its stock plummeting nearly 48% in a five-day whirlwind. With an RSI value languishing at 17.61, the company closed at $0.35 on Wednesday, marking a new low in its journey.

- Traders keeping an eye on Benzigna Pro’s real-time updates would have caught wind of the latest developments swirling around CONN.

Levi Strauss & Co LEVI

- On the horizon shines Levi Strauss & Co, with recent quarterly earnings outstripping expectations at 16 cents per share, a fraction above the projected 11 cents. Michelle Gass, the helm’s chief, attributed the success to the Levi’s brand’s cultural resonance, innovative products, and strong direct-to-consumer sales. Despite these triumphs, the stock has dipped 24% in the last month, hitting a 52-week low of $12.42.

- With an RSI value hovering at 25.55, Levi Strauss concluded Wednesday at $17.50. The plotted trajectory of LEVI’s stock trend was no secret to traders using Benzigna Pro’s insightful charting tool.

Read Next: