The consumer discretionary sector is seeing a surge in oversold stocks, creating a window of opportunity for investors to dive into undervalued companies.

One key metric drawing attention is the Relative Strength Index (RSI), a momentum indicator that helps evaluate a stock’s performance in the short term based on its price action. When the RSI falls below 30, it typically signals an oversold condition, indicating potential room for upward movement.

Let’s delve into the latest data on top oversold consumer stocks within this sector:

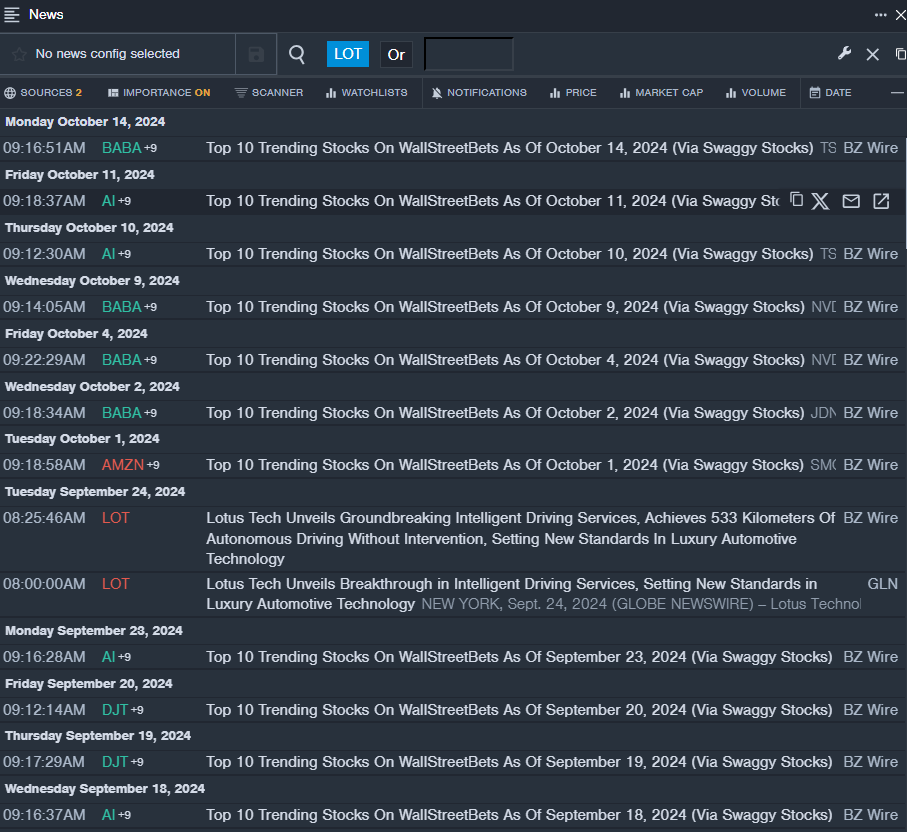

Lotus Technology Inc – ADR LOT

- Recent breakthroughs in intelligent driving services by Lotus Technology have set new standards in luxury automotive technology. Despite this, the company’s stock has dropped approximately 14% in the past month, hitting a 52-week low of $4.27.

- RSI Value: 27.96

- LOT Price Action: Lotus Technology’s shares experienced a 0.8% decrease, trading at $4.32 on Wednesday.

- Real-time updates from Benzinga Pro have been instrumental in tracking the latest news related to LOT.

Stride Inc LRN

- In a recent report titled “Stride Inc (LRN) – The Last Covid Over Earner – Hiding That Est >25% of EBITDA Came from Covid Funds” by Fuzzy Panda Research, concerning details came to light regarding Stride Inc. The company’s stock witnessed a downturn of about 20% over the last month, hitting a low of $43.77 in the 52-week range.

- RSI Value: 17.43

- LRN Price Action: Stride Inc shares tumbled by 6.6% to reach $65.94 on Wednesday.

- Analytical tools from Benzinga Pro proved critical in identifying the trend surrounding LRN’s stock performance.

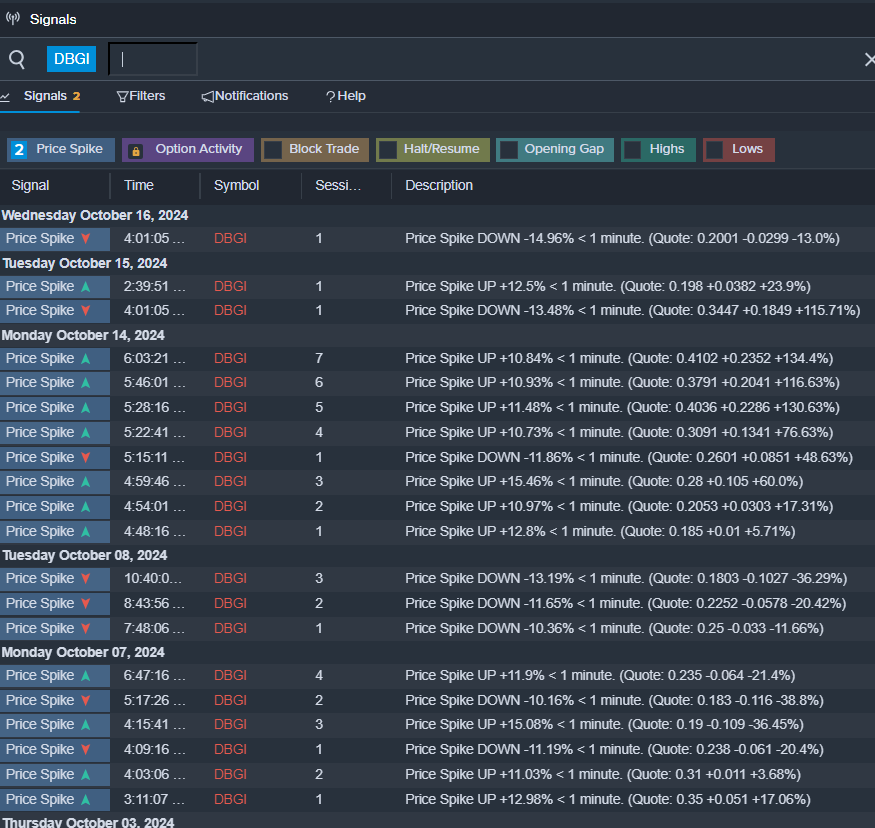

Digital Brands Group Inc DBGI

- Notable misfortunes befell Digital Brands Group as it received a delisting notice from Nasdaq due to failure in meeting continued listing standards. The company’s shares dwindled by approximately 59% over the past month, reaching a low of $0.14 in the 52-week timeline.

- RSI Value: 28.93

- DBGI Price Action: Digital Brands Group’s stocks closed at $0.20 on Wednesday after a 10.9% decline.

- Signals from Benzinga Pro hinted at a probable breakout in the shares of DBGI.

Read More:

Market News and Data brought to you by Benzinga APIs