Real estate stocks showing signs of being oversold may be ripe for the picking as opportunities emerge in undervalued companies.

The Intriguing World of RSI

The Relative Strength Index (RSI) can act as a guide, comparing a stock’s strength on upward versus downward price days. A stock is often seen as oversold when the RSI dips below 30, making it a potential target for investors seeking value.

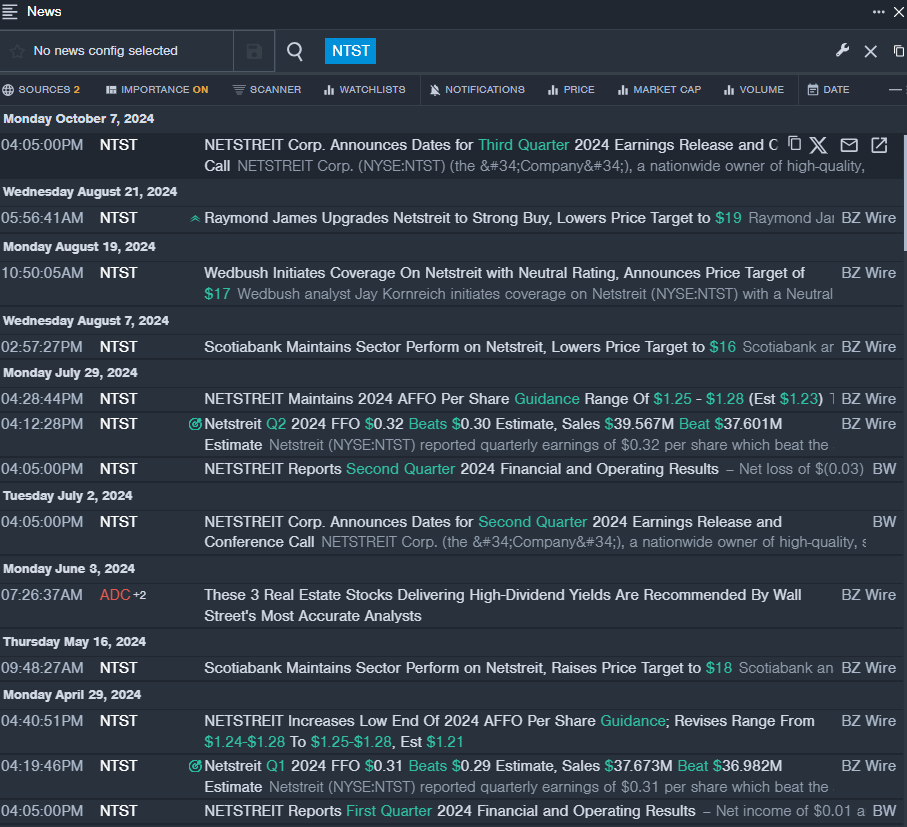

NetSTREIT Corp – Potential Sleeper?

- NetSTREIT is gearing up to unveil its third-quarter 2024 financial results post-market on Nov. 4, 2024, on the NYSE. The stock has slumped approximately 10% over the past month, hitting a 52-week low of $13.49.

- RSI Value: 27.18

- NTST Price Action: Ending Thursday at $15.44, NetSTREIT’s journey could be one to watch amidst these tumultuous times.

Lineage Inc – A Diamond in the Rough?

- Lineage is set to reveal its Q3 2024 financial results bright and early on Wednesday, Nov. 6, 2024. The stock has mirrored a 10% decrease over the past month, bottoming out at $73.16.

- RSI Value: 26.01

- LINE Price Action: Concluding at $73.99 on Thursday, Lineage’s narrative unfolds amidst market fluctuations.

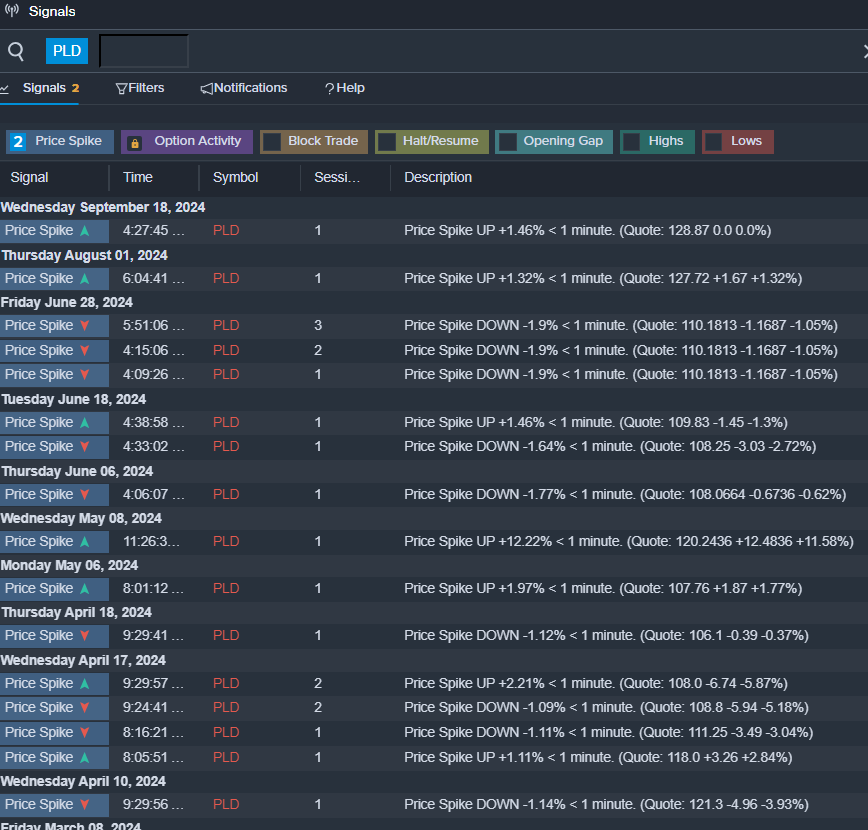

Prologis Inc – Navigating the Storm?

- Barclays analyst Anthony Powell recently reaffirmed Prologis with an Overweight status, though he adjusted the price target to $131 from $142 on Oct. 10. The company’s shares have tumbled around 11% over the past month, hitting a 52-week low of $10.02.

- RSI Value: 28.20

- PLD Price Action: Ending Tuesday at $118.28, Prologis’ story continues to evolve amidst market ripples.

Dive Deeper into Market Insights to Stay Informed