In the tumultuous terrain of the stock market, the information technology sector has undoubtedly borne witness to stocks that present a prime opportunity to capitalize on undervalued companies. This financial dance often hinges on noticeable oscillations in a stock’s price, as revealed by the Relative Strength Index (RSI) – a pivotal momentum indicator that dissects a stock’s strength during both uptrends and downtrends. When the RSI plunges below the 30 mark, it traditionally signifies that an asset is flirting with the realm of ‘oversold,’ painting a compelling picture for shrewd traders looking to seize a fleeting chance for profit.

The Troubled Waters of Super Micro Computer Inc

- On the ominous date of August 27, Hindenburg Research cast a shadow over the once-mighty Super Micro Computer Inc. The company, with shares that have weathered a staggering 36% plunge over the past month alone, now stands at a crossroads with a 52-week low of a mere $226.59.

- RSI Value: 25.38

- SMCI Price Action: Shares of Super Micro Computer witnessed a brutal 19% descent to conclude at $443.49 on a somber Wednesday.

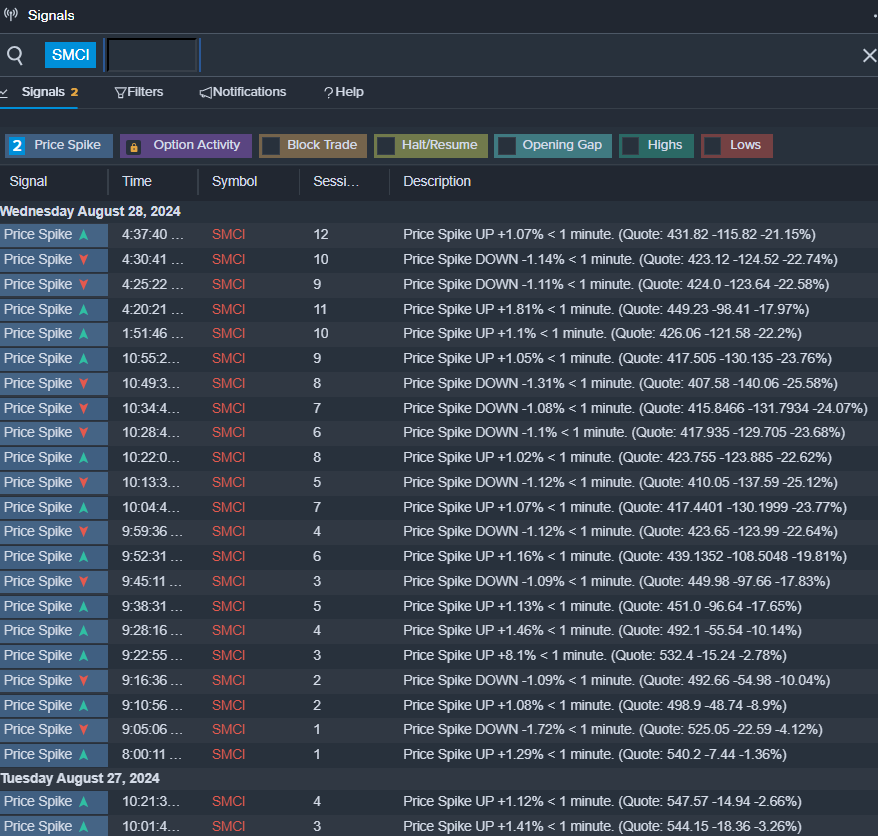

- Benzinga Pro’s astute signals feature subtly hinted at the possibility of a tumultuous breakout in the disheartened SMCI shares. A glimmer of hope in a bleak narrative.

The Impending Question Mark Over Super Micro Computer Inc

As investors gaze upon the once-proud empire of Super Micro Computer Inc, questions linger in the air like a haunting mist. Will this company stage a phoenix-like ascension from its current predicament, or is the descent into the abyss already ordained amidst the echoing doubts of the market?