As the Q4 earnings report date of Wednesday, January 24 looms large, the prospects of several household names remain exceedingly promising.

These dominant players in their respective domains have caught the eye of analysts and investors alike due to their potential to deliver robust quarterly performances. Here’s a closer look at a couple of top-rated Zacks stocks to keep an eye on.

Ace in the Insurance Sector – The Progressive

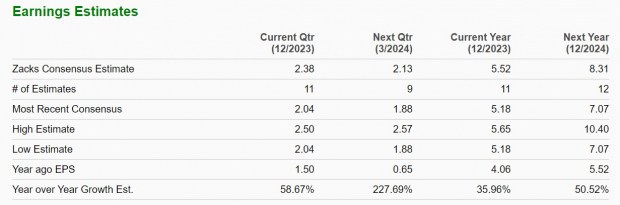

The Progressive Corporation (PGR), a giant in the home and auto insurance sector, is set to reveal its Q4 results, with analysts projecting a staggering 58% surge in earnings to $2.38 per share from $1.50 per share in the corresponding period.

Image Source: Zacks Investment Research

A remarkable 19% uptick in fourth quarter sales to $16.1 billion is also anticipated. Momentum is expected to persist, with high double-digit percentage growth projected for Progressive’s annual performance in fiscal 2024.

Image Source: Zacks Investment Research

Trading at a reasonable 20.4X forward earnings multiple, The Progressive Corporation (PGR) is witnessing share gains of +35% over the past year, underscoring the remarkable investor confidence in its exceptional growth trajectory.

Construction Sector’s Powerhouse – United Rentals

United Rentals (URI), the largest equipment rental company globally, is also geared up to announce its Q4 results, with analysts predicting an 11% earnings upswing to $10.85 per share, coupled with a 10% increase in sales to $3.63 billion.

Image Source: Zacks Investment Research

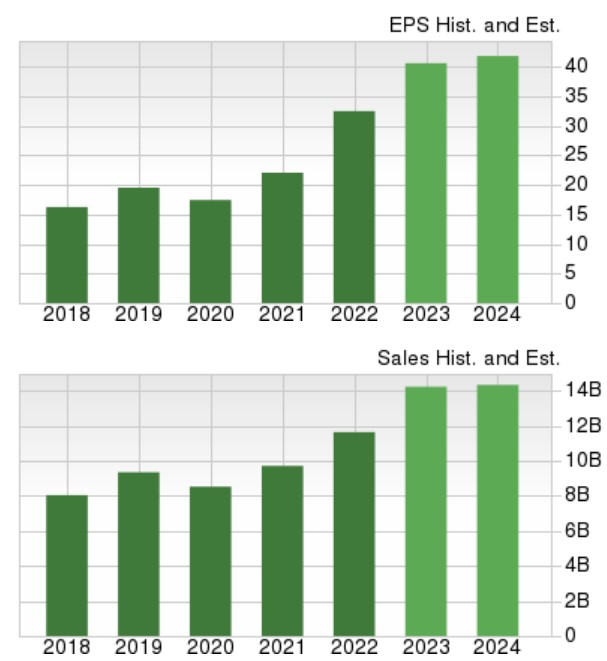

United Rentals (URI) is expected to wrap up FY23 with a 24% surge in EPS to a substantial $40.40 per share, accompanied by a commendable 22% rise in total sales to $14.23 billion. Projections for fiscal 2024 indicate a further 7% and 3% increase in EPS and sales, respectively.

Image Source: Zacks Investment Research

United Rentals (URI)’s shares have surged +47% over the last year, trading at a modest 13.1X forward earnings, indicating a slight discount to the Zacks Building Products-Miscellaneous industry average of 16.3X.

Additional Stocks to Keep an Eye On

Also garnering attention ahead of the earnings release are International Business Machines (IBM) and Abbott Laboratories (ABT), two companies poised for robust quarterly growth. Despite distinct market niches in computer and healthcare products, analysts anticipate solid performances from both enterprises. Notably, Abbott’s stock has remained relatively stable over the past year, whereas IBM shares have surged +22%.