The U.S. labor market, once viewed as on a trajectory of unyielding growth, now faces the sobering reality of revised job figures stretching from April 2023 to March 2024.

An astonishing 818,000 nonfarm payrolls previously depicted in official data have evaporated into a statistical purgatory.

This revision deflates the average monthly job gains to approximately 175,000, a far cry from the initially touted 242,000 figure.

Sectors like professional and business services, leisure and hospitality, retail trade, and manufacturing bore the brunt of the downward adjustments.

Conversely, upward revisions illuminated a silver lining in private education and health services, as well as transportation and warehousing.

These revelations paint a picture of a U.S. labor market that may not have burnt as bright as previously perceived, though still managing to clock in about 2.1 million gains annually up to March 2024.

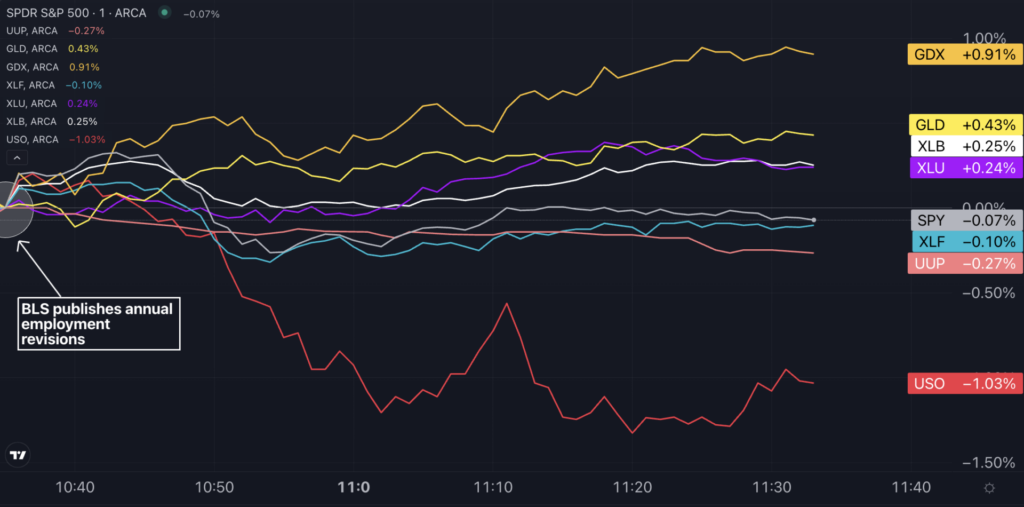

Market Response: Dollar Wanes as Rate-Cut Speculations Surge, Spurring a Rally in Utilities and Gold Miners

The redraft of the annual payroll data has turbocharged expectations for drastic Federal Reserve rate cuts, leading to an influx of bets on a 50-basis-point slash in September. The CME Group Fed Watch tool reports a spike in the likelihood of this scenario, surging to 34.5% from the prior day’s 29%.

Market experts are now pricing in a federal funds rate gravitating towards 4.25% to 4.5% by year-end, signaling a complete percentage point descent from current levels.

This shift has provoked a downturn in the U.S. dollar, with the Invesco DB USD Index Bullish Fund ETF (UUP) nullifying prior advances.

On the flip side, there was a positive ripple effect on gold prices following the data release, despite the SPDR Gold Trust (GLD) showing a 0.2% dip at 11:20 a.m. ET.

Commodities sensitive to growth, such as oil, witnessed a decline, with the United States Oil Fund (USO) plunging over 1% post-data release, and down 0.3% for the day.

While the S&P 500 teetered without significant movement, sectoral upheavals came to the fore. The Financial Select Sector SPDR Fund (XLF) nosedived following the revelations, whereas the Materials Select Sector SPDR Fund (XLB) and Utilities Select Sector SPDR Fund (XLU) saw upticks.

Within specific sectors, gold miners saw a reversal of fortunes, with the VanEck Gold Miners ETF (GDX) making a dramatic shift from early losses to gains.

Chart: Impact of Revised Employment Data on 7 ETFs

Read Next:

Image created using artificial intelligence via Midjourney.