Trump Media & Technology Group DJT has been on a rollercoaster ride, experiencing a 44.6% surge in the past month with a remarkable year-to-date gain of 38%.

Despite a slight dip of 25% over six months, recent advancements have injected a fresh wave of optimism, especially following the debut of the Truth+ Streaming App on Android devices, now accessible on the Google Play Store.

As the Truth+ app takes center stage, Trump Media’s stock is shedding its past woes and forging ahead, fueled by robust technical signals and mounting investor enthusiasm.

Read Also: Trump Media Stock Surges as Elon Musk Backs Trump at Pennsylvania Event

Truth+ Streaming App: A Game Changer?

Truth+ isn’t merely a run-of-the-mill streaming service; it represents a pivotal element in Trump Media & Technology’s quest to construct a platform impervious to Big Tech’s sway. The app, available on Android, offers a diverse array of content ranging from news and entertainment to faith-based programs and children’s shows.

Equipped with Video on Demand (VOD), live TV rewind, catch-up TV, and DVR features, Truth+ significantly expands upon the existing content library found on Truth Social.

CEO Devin Nunes underscored the significance of this launch, asserting, “We have achieved another milestone in our mission to establish an uncancellable sanctuary for free speech.” Nunes also hinted at forthcoming expansions, including native apps for iOS, Samsung, LG, Apple TV, and more.

Trump Media Stock Displays Numerous Bullish Signals

On the technical front, Trump Media stock is ablaze.

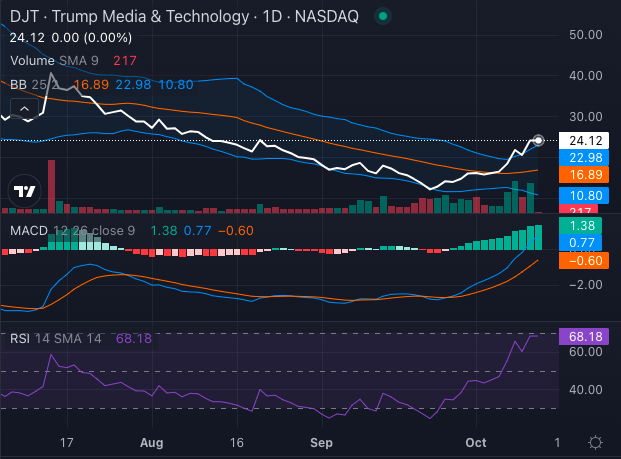

Chart created using Benzinga Pro

Trading at $27.27, Trump Media’s stock comfortably surpasses its five, 20, and 50-day exponential moving averages. The eight-day simple moving average stands at $20.08, the 20-day SMA at $16.90, and the 50-day SMA at $19.83—all signaling a bullish trend.

Furthermore, with the Moving Average Convergence Divergence (MACD) at 0.77, investors find additional reasons to back Trump Media’s stock.

Signs of Caution: Identifying Weakness

Chart created using Benzinga Pro

Nonetheless, not all is shining brightly for Trump Media’s stock. Priced at $24.12, it lags far behind its 200-day simple moving average of $33.97, hinting at some underlying frailty.

The Relative Strength Index (RSI) also nears overbought territory at 68.18, suggesting a potential pullback in the stock’s value soon.

Additionally, the Bollinger Bands depict Trump Media trading beyond the upper band range of $16.89 to $22.98, another sign urging cautious optimism.

Despite these weak spots, propelled by the Truth+ app’s launch momentum, the bullish sentiment remains palpable.

Future Trajectory for Trump Media Stock

Charting a course ahead, Trump Media & Technology shows no signs of halting its expansion plans, with iOS and connected TV platforms in the pipeline.

The company persists in rigorously stress-testing its custom-tailored, uncancellable streaming technology, and any successful updates or expansions could stoke further investor interest in the days to come.

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs