Following a dramatic 48% cut in its dividend, Walgreens Boots Alliance (NASDAQ: WBA) no longer boasts the highest yield in the Dow Jones Industrial Average. Despite the slash, Walgreens still yields 4%, leading some investors to consider it a potential turnaround prospect following a reduction in expenses and an influx of cash for operational enhancements.

However, Walgreens’ weak fundamentals and declining earnings render it a risky endeavor despite the potential upturn. Here’s why Apple (NASDAQ: AAPL), Procter & Gamble (NYSE: PG), Johnson & Johnson (NYSE: JNJ), Walmart (NYSE: WMT), and Chevron (NYSE: CVX) emerge as superior choices for Dow dividend stock purchasers.

Image source: Getty Images.

Apple’s Share Buybacks Elevate Its Value Proposition

Apple offers a modest 0.5% yield, an outcome of its outperforming stock price, rather than a lack of dedication to its dividend.

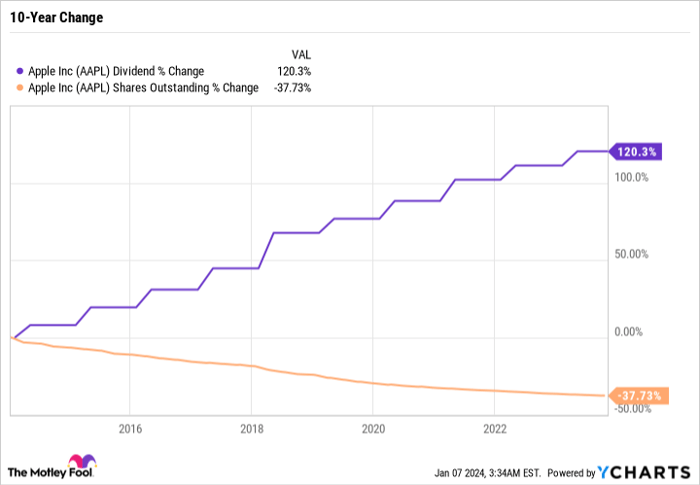

Since 2012, Apple’s management has consistently amplified its dividend. Over the past decade, its dividend has more than doubled, coinciding with a 37.7% reduction in its outstanding share count, a result of buybacks.

AAPL dividend data by YCharts.

Apple’s cash-generating model empowers it to enhance dividends and repurchase stock, even during sluggish periods, as observed in recent years.

For investors prioritizing a sound business, buybacks, and incrementing dividends over a high yield, Apple stands as an appealing dividend stock.

Procter & Gamble’s Robust Standing in the Market

Similar to Apple, P&G isn’t merely a dividend play. It also features a substantial buyback program and sustains an exceptionally solid business model.

Although it significantly underperformed the market in 2023, P&G’s stock presents patient investors with the opportunity to acquire a high-quality business at a favorable valuation.

P&G is among the best-managed businesses, commanding leadership in the entire consumer staples sector. With unrivaled pricing power and top-notch products across various categories, including beauty, grooming, healthcare, and home care, P&G has a track record of developing high-performing brands.

P&G’s high-margin, diversified business model, resilience during economic downturns, and moderate price-to-earnings ratio of 23.9 render it a worthwhile acquisition despite its gradual growth.

Johnson & Johnson: A Picture of Financial Resilience

Similar to P&G, Johnson & Johnson, a Dividend King with over 60 years of consecutive dividend hikes, stands as one of the most dependable healthcare income stocks.

The revamped J&J has reallocated its consumer-healthcare products into a new entity, Kenvue. With a focus on pharmaceuticals and medical devices, the “new” J&J is likely to experience accelerated growth, albeit a change from its historical stance, notorious for reliability rather than growth pursuit.

J&J’s robust cash flow, negligible long-term debt, and a 3% dividend yield solidify its position as a dependable dividend stock.

Walmart: A Defensive Play in Turbulent Markets

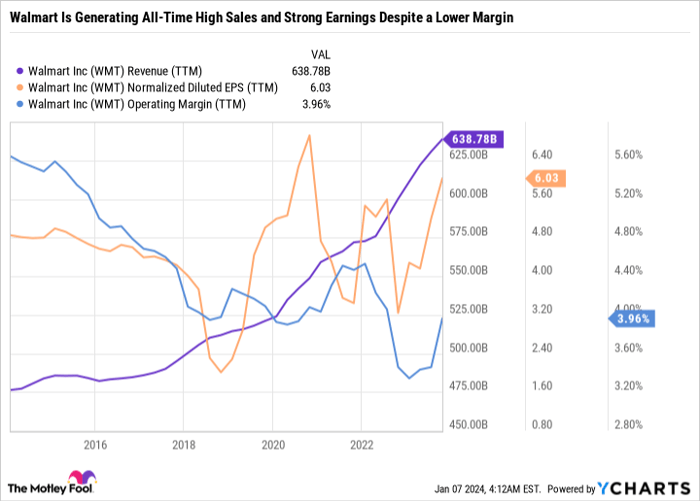

Walmart’s 1.5% yield pales in comparison to J&J; nevertheless, it showcases resilience and innovation, prioritizing reinvestment over significant dividend increments. Armed with an intricate supply chain, Walmart emerges as a sanctuary during economic instability.

The retail giant’s performance during adverse economic conditions underscores its prowess in securing market share and offering optimum value to customers.

Old School Stocks Weather the Storm

WMT revenue (TTM) data by YCharts; TTM = trailing 12 months.

In the wake of shifting consumer behavior amidst economic uncertainty, old school stocks like Walmart and Chevron have proven resilient. Walmart’s limited dependence on discretionary categories has allowed the company to shine through challenging times. Meanwhile, Chevron’s diversified portfolio and relentless dividend raises since 1990 position it as an undervalued dividend stock, capable of withstanding steep drops in oil prices.

Chevron’s Resilience in a Volatile Sector

Chevron, with its 4% dividend yield, has exhibited remarkable stability, showcasing the ability to maintain payouts even when oil prices plummet. The company’s robust balance sheet, along with investments in low-carbon efforts and a sizable downstream business, fortify its position in the volatile oil industry. Despite the unpredictable nature of the sector, Chevron stands as a beacon of reliability for income-seeking investors.

Quality Dividends Reign Supreme

Amidst a diverse array of companies, including Apple, Procter & Gamble, Johnson & Johnson, Walmart, and Chevron, there exists a common thread – the ability to fund dividend raises through sustainable business growth. These companies, emblematic of their respective sectors, exemplify the ideal model for investors seeking reliable businesses that can weather the storms of economic uncertainty. In stark contrast to Walgreens’ market share decline and ill-fated dividend raises, these five old school stocks stand out as beacons of stability and resilience.

So, what’s the bottom line for investors? In January, these five stocks are solid bets for those seeking quality businesses that can stand the test of time, regardless of what the new year brings.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 8, 2024

Daniel Foelber has positions in Target and has the following options: long November 2024 $130 calls on Target and short November 2024 $135 calls on Target. The Motley Fool has positions in and recommends Apple, Kenvue, Target, and Walmart. The Motley Fool recommends Chevron and Johnson & Johnson and recommends the following options: long January 2026 $13 calls on Kenvue. The Motley Fool has a disclosure policy.