Brokers on Wall Street have painted a rosy picture for Cava (CAVA), tipping the scale towards optimism. But should you place your bets solely on their call? Let’s dissect the dynamics of brokerage recommendations and equip you with a sharper lens for your investment decisions.

Peering into Broker Recommendations for Cava

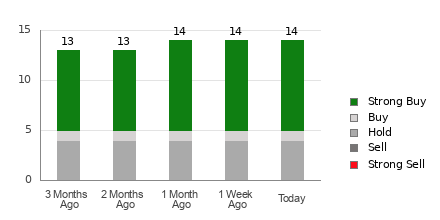

Cava currently rides on an average brokerage recommendation (ABR) of 1.61, nudging between Strong Buy and Buy territories. This calculation stems from inputs of 14 brokerage firms, with nine advocating a Strong Buy and one standing firm on Buy – composing 64.3% and 7.1% of recommendations, respectively.

Broker Ruling Trends for CAVA

Despite the positive chorus, treading cautiously is sage. Historical evidence elucidates the limited efficacy of brokerage cues in pinpointing stocks with a rising price trajectory. Analysts often wear tinted glasses, viably tinted by the stocks they tout. For every grim “Strong Sell” tag, five “Strong Buy” endorsements flicker, underscoring a distortion that clouds an investor’s view.

Our rudder in turbulent waters, the Zacks Rank, stands tall with a proven track record. Graded from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), this yardstick unfurls a reliable narrative of a stock’s forthcoming price performance – a potent companion to the ABR.

Delineating Zacks Rank from ABR

While ABR crystallizes broker affirmations in decimal figures, the Zacks Rank dances to a different tune – anchored in earnings estimate churns. Upheld by a plinth of empirical truths, the Zacks Rank ebbs and flows aligned with earnings winds, homing closer to the heart of stock price throbs.

Unlike the ABR’s temporal vagaries, the Zacks Rank boasts a leaf out of patrons’ long-drawn yawns, ensuring the freshest stance on prevailing market tunes. Stitched with earnings whispers, its tapestry resonates with a resonant hum that reverberates near-term babble impeccably.

Cava: A Diamond in the Rough?

Whispers from the grapevine echo an uptick in Cava’s earnings compass, nudging the Zacks Consensus Estimate for the ongoing year up by 2.9% to $0.25. This rallying cry finds harmony in analysts’ unison symphony, propelling a Zacks Rank #2 (Buy) for Cava – embers hinting at a fiery leap in the imminent spell.

Steering back to Cava, the brokerage-backed ABR laurel bodes well as a compass needle for the discerning investor.

Ray of Hope Amidst Mayhem

A beacon in the storm, Bitcoin has stood as a paragon of investment shrewdness, eclipsing its decentralized counterparts in the race for riches. Amidst political rumbles, its glints beckon, with returns painting a saga of triumph – 2012 +272.4%, 2016 +161.1%, and 2020 +302.8%. Zacks predicates a fresh gust embracing horizons yet uncharted.

Delve into the past for cues, but tether your ride to the stars for a dance with destiny. The future hangs in a balance, waiting to unfold its mysteries in the folds of time.