The Market Responds with Discontent

Today’s Consumer Price Index (CPI) figures surprised many with a cooler reading, signaling a triumph against inflation. The 0.2% month-over-month increase aligned with Dow Jones’ expectations, pushing the annual rate down to 2.5%, noticeably lower than the previous month’s 2.9% surge.

However, core inflation took a slight detour, climbing 0.3% on the month, exceeding the projected 0.2%. The corresponding 3.2% year-over-year reading remained in line with forecasts.

The most stubborn spike stemmed from housing-related expenses, as the shelter component of the index rose by 0.5% monthly and 5.2% annually.

A Market Rollercoaster

Stocks plummeted early in response, but as the day unfolded, a recovery began, with the Nasdaq even flipping into positive territory. The market fixated on the core inflation uptick, dampening hopes for an aggressive 50-basis-point interest rate cut next week.

However, today’s turmoil begs the question: why does Wall Street crave such a dramatic rate slash?

Historical Lessons Point Towards Moderation

Despite the market clamoring for a hefty rate cut, a deeper dive into historical data suggests otherwise. Past market performances reveal a notable preference for modest 25-basis-point cuts.

Lukas Downey, an esteemed analyst, underscores this stance, highlighting the substantial advantages of opting for more conservative cuts.

The disparity in the S&P’s 12-month and 24-month performance post-“slow rate cuts” versus “fast rate cuts” emphasizes the viability of a measured approach over impulsive decisions.

The Case for Prudence

With significant ramifications at stake, it becomes evident that prudence outweighs haste in the current scenario. A judicious 25-basis-point cut aligns better with the market narrative of a ‘soft landing,’ ensuring a gradual economic correction rather than a hasty intervention.

Furthermore, the data hints at the potential repercussions of an unwarranted jumbo cut, stirring doubts about the Fed’s economic confidence.

Rethinking Investment Assumptions

Diving into investment philosophy, a profound reevaluation emerges. The conventional ‘if…then…’ strategy, deeply ingrained in investors, may falter in the face of market realities.

Challenges to presumed investment success narratives reveal the fickle nature of market outcomes, urging a shift in focus toward more concrete wealth-building strategies.

The Unyielding Reality of Stock Price Movement

Ultimately, amidst varying investment doctrines, the unwavering truth of stock ownership emerges: the sole wealth determinant is the price trajectory during one’s ownership period.

Embracing this paradigm shift emphasizes the supremacy of price momentum in formulating a robust investment strategy, transcending traditional metrics of success.

The Power of Price: A Guide to Strategic Investment

Embracing Price Action in Investment

When it comes to the intricate dance of investments, the concept can seem daunting but, in reality, the philosophy underlying successful strategies is rather elementary. If the stock in your portfolio is on an upward trajectory, you ride the wave to wealth. Conversely, if the stock is floundering or stagnating, prudence dictates steering clear – irrespective of the babble from other indicators.

Indeed, in the world of investments, price reigns supreme. The veracity of this statement is palpable when considering your retirement fund, your child’s college fund, or the long-awaited down payment for that lakeside abode.

So why complicate matters with hypothetical scenarios and assumptions? Why not cut through the noise and center your focus solely on the price action?

The Methodology of Stage Analysis

The expertise of our hypergrowth authority, Luke Lango, lies in his pragmatic approach to trading through his esteemed service, Breakout Trader. Luke’s modus operandi centers around “Stage Analysis,” a market framework that is deceptively simple.

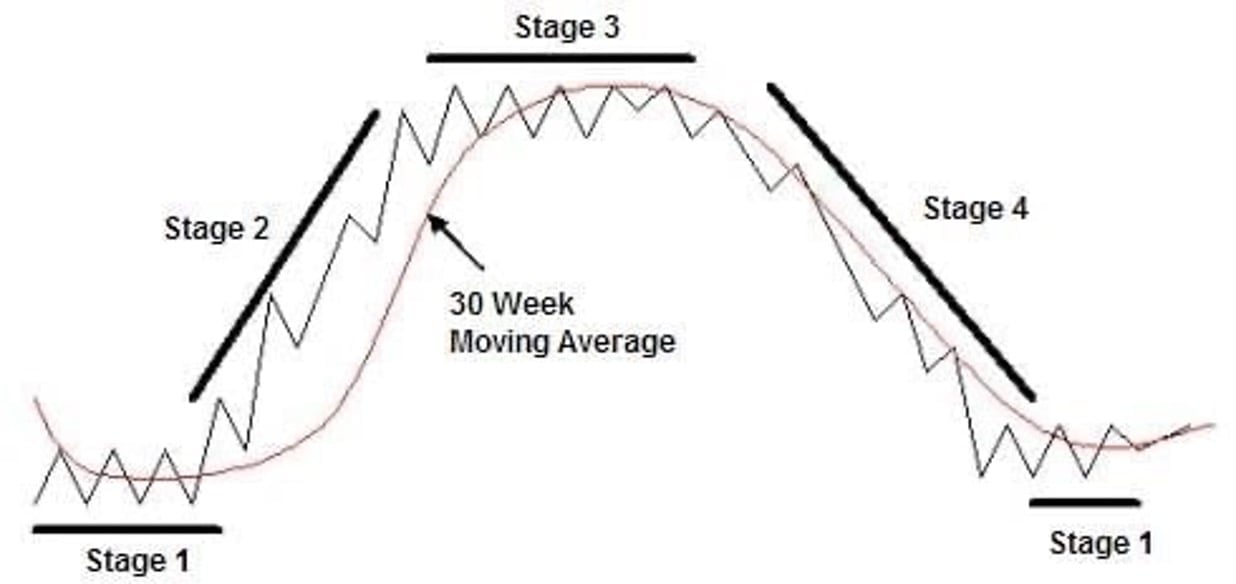

In essence, any asset at any given moment is either ascending, descending, or treading water. Each asset is situated in one of four distinct stages: 1) lateral movement at a trough, 2) ascending, 3) lateral movement at a peak, or 4) descending.

Stage analysis is akin to the compass guiding investors in deciphering a stock’s current phase and thereby advocating for investment only during the surge of Stage 2. This methodology places an uncompromising emphasis on price, the lone variable with a direct impact on your financial well-being.

Echoing Luke’s sentiment, the pivotal factor affecting your portfolio’s fate hinges upon the stocks under your ownership appreciating in value throughout your tenure.

Imagine owning a fundamentally dismal company, marred by poor financials and incompetence in an ailing industry. But what if, against all odds, the stock price charted a course of growth, doubling from $5 to $10? In this scenario, it’s safe to say that the negative attributes pale in comparison to the burgeoning value of the stock while under your possession.

Shifting Focus towards Pragmatism

A realm centered on price action frees investors from the futile exercise of crystal ball gazing into interest rate predictions or entangling themselves in if/then conjectures. The crux remains assessing an asset’s verity, as portrayed solely through its price movements, and responding accordingly.

The nuances of our discussion today have been trimmed due to spatial confines in the Digest. Questions linger – How do you accurately discern Stage 2 from the other phases? Which timeframe best informs this judgment call? What are the key indicators illuminating each stage? How can you fortify yourself against mislabeling a stage?

Tonight at 8 PM EST, Luke is hosting the “Great Tech Reversal of 2024” event. While it centers on a seismic shift in the economic and investment landscapes forecasted by Luke to unleash a plethora of opportunities, the tactical play remains rooted in Stage Analysis. This event promises an exploration of these unresolved queries and more.

Prepare for an insightful evening of market elucidation and portfolio stratagem, delving further into the realm of stage analysis.

Reserve your spot now and anticipate an enriching session this evening at 8 PM EST.

Wishing you a fruitful evening,

Jeff Remsburg