In the tumultuous sea of financial markets, investors often seek solace in dividend-yielding stocks. These stalwart companies, buoyed by robust free cash flows, generously reward their shareholders with high dividend payouts.

For those looking to glean insights from the sharpest minds on Wall Street, a deep dive into analyst takes on popular stocks can offer a treasure trove of information. By sifting through Benzinga’s comprehensive database of analyst ratings, traders can uncover valuable perspectives, especially from the most accurate analysts.

Let’s explore the latest ratings from the crème de la crème of Wall Street analysts for three high-yielding consumer stocks in the discretionary sector.

The Kohl’s Conundrum

- Dividend Yield: 9.66%

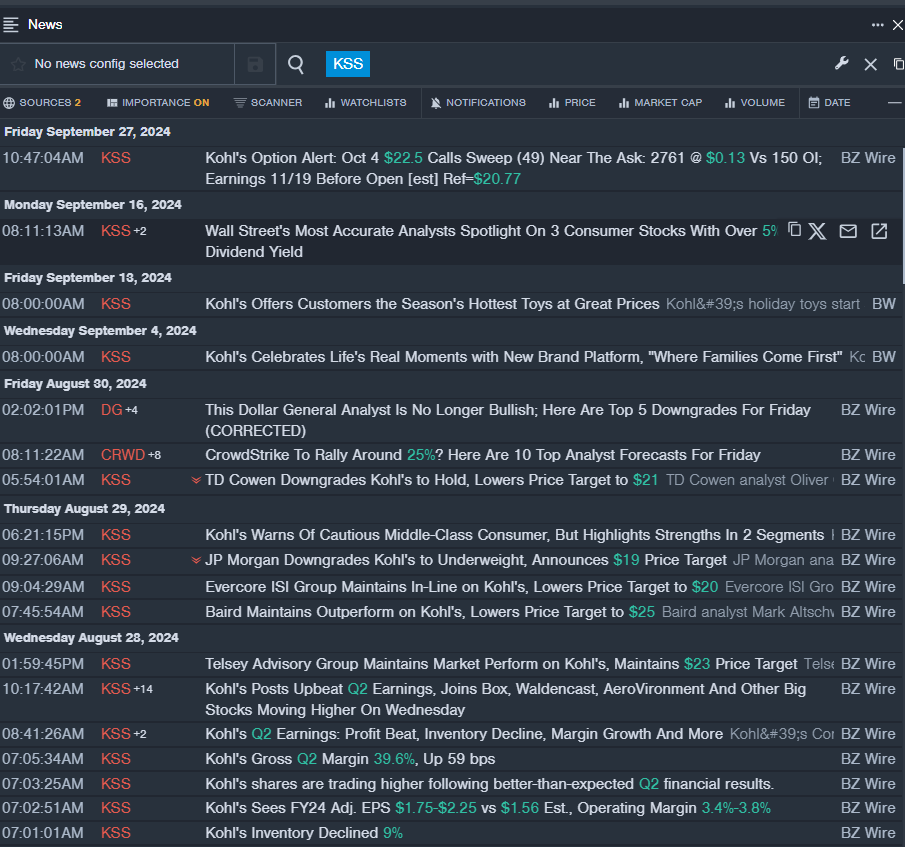

- JP Morgan analyst Matthew Boss threw a curveball by downgrading Kohl’s Corporation (NYSE:KSS) from Neutral to Underweight on Aug. 29, setting a price target of $19. Boss boasts a respectable accuracy rate of 68%.

- Evercore ISI Group analyst Michael Binetti, on the other hand, opted to maintain an In-Line rating but slashed the price target from $22 to $20 on the same day, exhibiting a 62% accuracy rate.

- Breaking News: On Aug. 28, Kohl’s surprised the market with better-than-expected second-quarter financial results that turned heads.

- Stay in the know with real-time updates from Benzinga Pro’s newsfeed on all things KSS.

The Guess? Game

- Dividend Yield: 6.09%

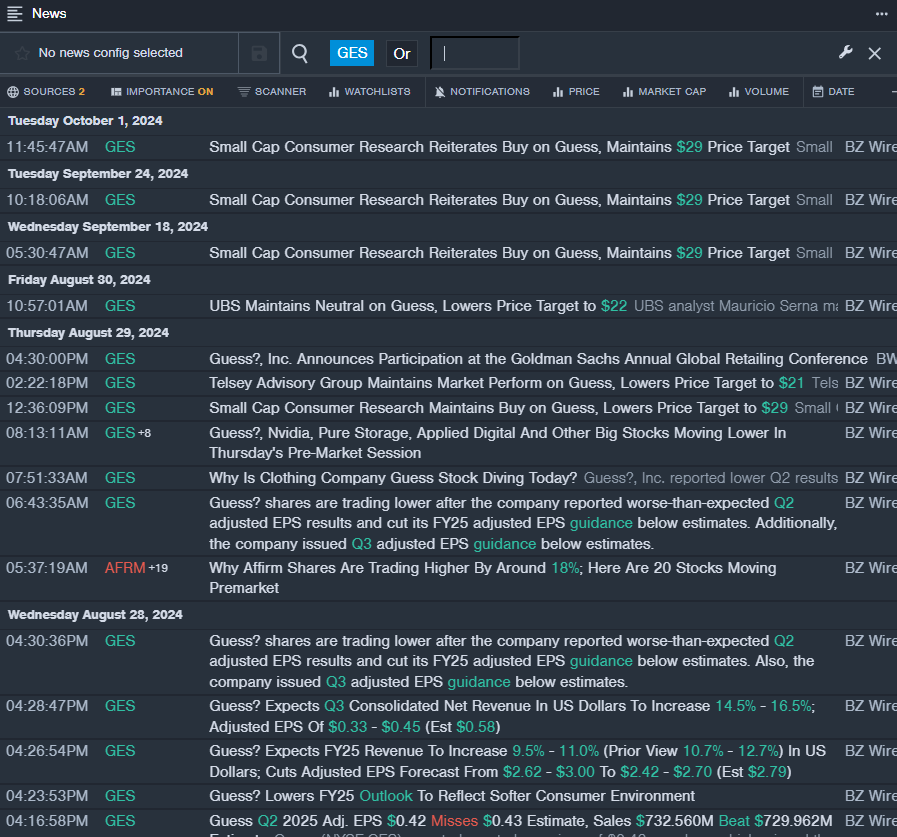

- Small Cap Consumer Research analyst Eric Beder stood by Guess?, Inc. (NYSE:GES) with a reaffirmed Buy rating and a price target of $29 on Oct. 1, showcasing a 64% accuracy rate.

- Telsey Advisory Group analyst Dana Telsey chose to maintain a Market Perform rating but decreased the price target from $26 to $21 on Aug. 29, wieldings a 61% accuracy rate.

- Late-Breaking News: On Aug. 28, Guess? fumbled the ball with worse-than-expected second-quarter adjusted EPS results and a dismal FY25 adjusted EPS guidance that fell short of estimates.

- Keep your finger on the pulse with Benzinga Pro’s real-time news alerts on all things GES.

The Wendy’s Watch

- Dividend Yield: 5.66%

- JP Morgan analyst John Ivankoe stood firm with a Neutral rating but upped the price target from $20 to $22 on Sept. 16, boasting an impressive 75% accuracy rate.

- TD Cowen analyst Andrew Charles echoed a Hold rating with a price target of $17 on Sept. 9, showcasing an outstanding 80% accuracy rate.

- Emerging News: On Sept. 16, The Wendy’s Company revealed key executive leadership shifts, shaking up the industry landscape.

- Stay ahead of the curve with Benzinga Pro’s insightful charting tool that tracks all the latest trends in WEN stock.