The Evolution of IBM

Currently sitting at a market cap of approximately $205 billion, International Business Machines (NYSE: IBM) finds itself on the brink of a potential resurgence. As IBM pivots towards a cloud and artificial intelligence (AI) focus, its journey to reclaim past glory is gaining momentum.

For IBM to scale the heights of a trillion-dollar valuation in the next six years, an annual stock price surge of 30% is imperative. Such a lofty goal seemed far-fetched in the previous decade, but recent developments mark a fundamental shift in IBM’s DNA. Transformation catalyst Arvind Krishna kick-started this new chapter with the $34 billion Red Hat acquisition, significantly amplifying IBM’s debt load. The gamble paid off as Krishna ascended to the CEO throne the following year, orchestrating a series of strategic moves and company restructurings.

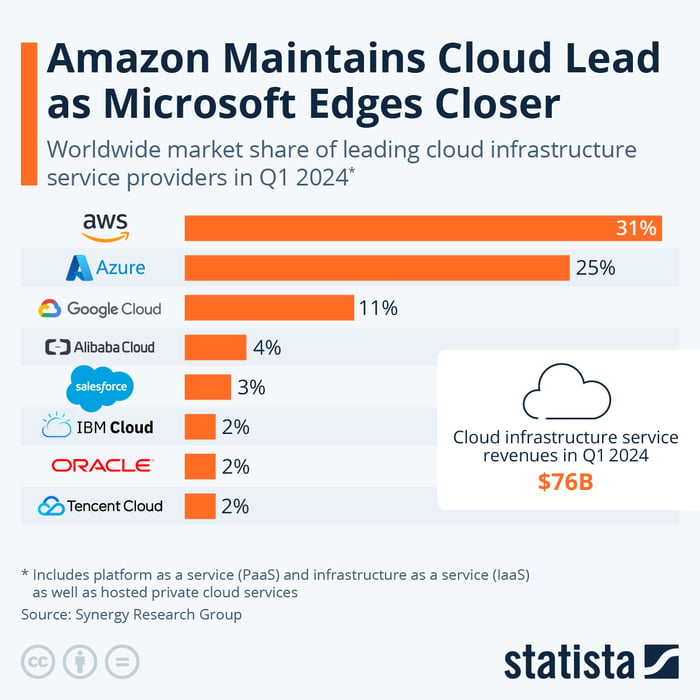

Notably, IBM now commands a 2% stake in the cloud infrastructure realm, a figure projected to ride the coattails of the expanding global cloud market, set to skyrocket to $2.4 trillion by 2030. IBM’s impressive foray into the generative AI landscape with watsonx underscores its resurgence, with current generative AI business standing at a robust $2 billion.

Image source: Statista.

While over half of IBM’s revenue still emanates from its consultancy and infrastructure units, software reigns supreme and keeps IBM a pivotal player in the technology domain.

Unpacking IBM’s Financial Markers

Recent financial performance metrics might temper the trillion-dollar aspirations of investors eying IBM. Despite a 37% annual surge in net income to $3.4 billion in the first half of 2024, overall revenue nudged up a mere 2% year-over-year. The modest growth trajectory, particularly in IBM’s core revenue streams, presents a challenge to the aspirational $1 trillion mark.

IBM’s profit spike was partly aided by a one-time income tax benefit. With prospects of this being a fleeting gain, IBM’s fundamental growth engine may not sustain the requisite momentum to catapult it into trillion-dollar territory.

The current resurgence in IBM’s stock price, surging nearly 60% in the last year to achieve a record high, brings its P/E ratio into the 25 range. This valuation, coupled with historically subdued P/E levels for IBM during periods devoid of profit upswings, raises doubts about the pace of future growth for the tech giant.

Probing the $1 Trillion Predicament

Forecasting a $1 trillion market cap for IBM in the next six years seems a stretch given its current financial trajectory. Yet, the revival of Big Blue, galvanized by its cloud footprint and watsonx endeavors, signals a tech renaissance, potentially propelling its stock price.

Nonetheless, with growth rates hovering in the mid-single-digits, IBM might face slower expansion relative to its industry cohorts. The solitary tax-fueled profit leap appears unsustainable, signaling a possible profitability slump post-cessation of favorable tax treatment.

Investors anticipating a meteoric rise may need to temper expectations, setting a slightly more earthly target for IBM.

Uncover Lucrative Opportunities

For those who rue missed opportunities in stock market successes, a noteworthy revelation awaits. Periodically, analysts unveil ‘Double Down’ recommendations for poised-to-boom enterprises. Seizing this chance before it eludes you could be a game-changer, just as past success stories exemplify:

- Amazon: $1,000 investment post-2010 ‘Double Down’ fetched $20,579!

- Apple: $1,000 post-2008 call turned into $42,710!

- Netflix: $1,000 after the 2004 ‘Double Down’ translated to $389,239!

With three promising ‘Double Down’ alerts currently live, the clock is ticking on potentially unparalleled market opportunities.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024