The Surge of Nvidia Stock on Monday

Nvidia Corp NVDA stock is witnessing an upward trend on Monday, sparking interest and attention within the financial markets.

The Shift in Valuation and Investor Appeal

In a recent Bloomberg interview, Ken Mahoney highlighted that Nvidia’s valuation has dropped to approximately 30 times forward earnings following a recent selloff. This decline in valuation may potentially attract long-term investors who seek value in the current market scenario.

Nvidia’s Success Story Unraveled

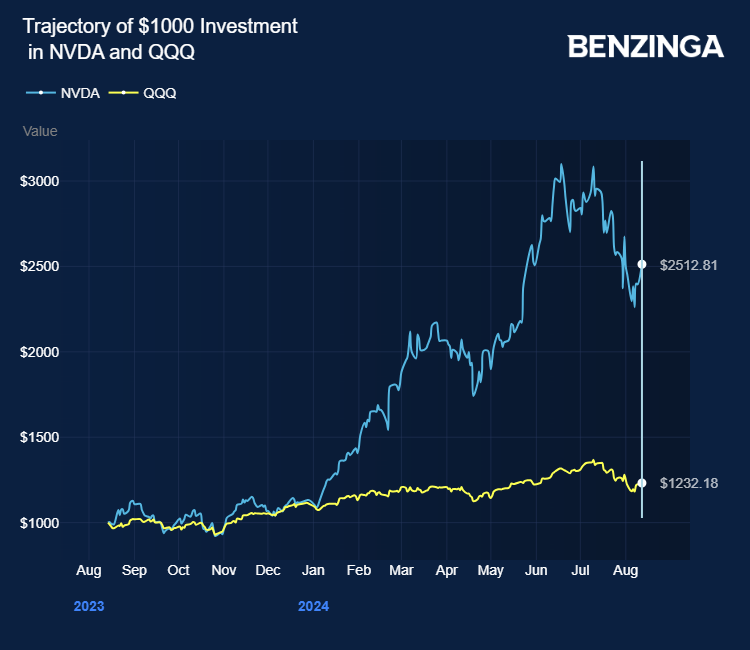

Nvidia’s remarkable journey includes a 152% surge in the past 12 months, despite experiencing a minor setback of around 15% in the preceding 30 days.

The heart of Nvidia’s achievement lies in the creation of a “walled garden,” drawing in developers who build AI systems and software utilizing Nvidia’s high-performance chips. This strategic ecosystem, anchored around Nvidia’s CUDA software platform, has set a high barrier for competitors trying to make inroads in the AI sector.

The Dominance of Nvidia in AI Chip Market

Nvidia’s relentless focus on coding proficiency and innovation has paved the way for CUDA, a groundbreaking software platform introduced in 2007. CUDA empowers Nvidia’s GPUs to efficiently run non-graphics applications, particularly AI programs.

Jensen Huang, the visionary CEO of Nvidia, advocates for a holistic approach to computing termed “full-stack computing.” Under this paradigm, Nvidia not only supplies cutting-edge chips but also delivers the requisite software for constructing advanced AI systems.

These strategic moves have firmly entrenched Nvidia as the frontrunner in the AI chip market, boasting an estimated 90% market share that is poised to endure over the coming years.

Future Outlook and Market Projections

Industry forecasts predict that the AI chip market is set to hit a monumental $400 billion annually by 2027, further bolstering Nvidia’s growth prospects and market dominance.

Investment Opportunities

For investors seeking exposure to Nvidia’s success, options include investment in VanEck Semiconductor ETF SMH and Schwab U.S. Large-Cap Growth ETF SCHG, offering a gateway to participate in Nvidia’s promising trajectory.

Positive Price Action

As of the latest check on Monday, NVDA shares have surged by 5.30% and were trading at $110.24, reflecting continued investor optimism and market confidence in Nvidia’s resilience and growth potential.

Disclaimer: This content underwent AI-assisted production and subsequent review by Benzinga editors before publication.

Image via Nvidia Blog