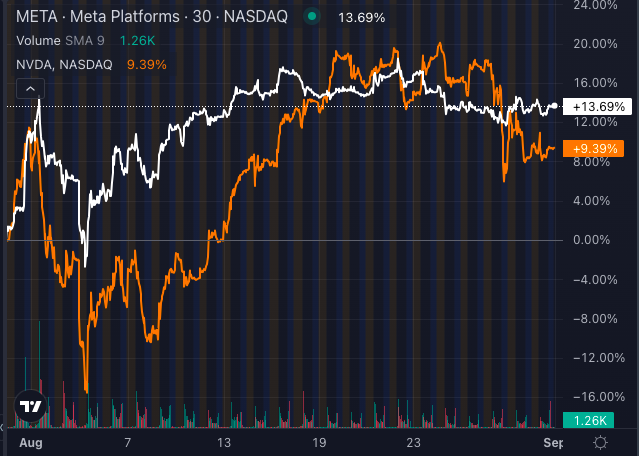

Meta Platforms Inc META outshined Nvidia Corp NVDA in August, with Meta stock gaining 13.69% compared to Nvidia’s 9.39% surge.

This unexpected turn of events has ignited a debate regarding whether Nvidia, the stalwart of AI, is encountering a sobering moment of valuation reassessment.

Chart created using Benzinga Pro

Nvidia’s High-Flying Act: Is The Bubble Bursting?

For Nvidia, a dominant force in AI chips and GPU technology, the road has been paved with success, fueled by the escalating demand for AI and data center solutions. However, the company’s elevated valuation — currently perched at a price-to-earnings multiple (P/E) of 55.13 — a notable premium compared to its counterparts — is beckoning scrutiny over the sustainability of its upward trajectory.

The modest uptick in Nvidia’s stock price throughout August hints at a potential reevaluation by investors of its lofty price tag.

Read Also: Nvidia Down About 10% From All-Time Highs: Prominent Trader Says He Has Cashed Out

Questions linger about whether Nvidia can uphold the explosive growth necessary to rationalize its valuation, a sentiment that seems to be weighing on investor sentiment.

Meta’s AI Magic: New Kid On The Block Shines

On the other hand, Meta is basking in the glow of its strategic pivot towards AI. Leveraging AI to boost its advertising efficiency and user experience, Meta has seen a resurgence in its stock value. The investments Meta has made in AI technology are now starting to bear fruit, offering a more diversified prospect in the tech domain.

Read Also: Mark Zuckerberg’s AI Obsession: Is $8 Billion Too Much For Meta To Handle?

Investors are evidently responding positively to this strategy, viewing Meta as a robust contender in the AI realm without the valuation risks associated with Nvidia.

Valuation Showdown: Is Nvidia’s Crown Slipping?

The recent divergence in performance could signify a broader tilt in market sentiment, signaling that investors are growing more cautious about overvalued tech shares. While Nvidia remains a pioneer in AI innovation, the deceleration in its stock momentum might indicate that the market is seeking more balanced, less risky AI ventures.

As deliberations unfold, investors must balance Nvidia’s promising growth potential against its valuation hazards. With Meta demonstrating its proficiency in exploiting AI without shouldering the same hefty price tag (trading at a P/E of 26.51), the quandary persists: Is Nvidia encountering a brief cooldown, or does it herald a lengthier trend?

Only time will unveil whether Nvidia can reclaim its luster, or if Meta’s diversified AI strategy will persist in upstaging its technological peer.

Read Next: