Preview: Today, we delve into the catalysts driving the “smart money” towards MSCI Argentina ETF (ARGT), Russell 2000 Index ETF (IWM), iShares Bitcoin Trust ETF (IBIT), Alibaba (BABA), and JD.com (JD).

Tracing the Smart Money Moves

Amidst the cacophony of Wall Street, where distractions abound, investors face a myriad of influences. From financial pundits on TV to rapid-fire news updates on trading platforms, the investing landscape is filled with noise. Creating a robust system, honing it for efficacy, and filtering out the clamor are crucial steps for investors. While reinventing the wheel is unnecessary, gaining insights from seasoned insiders and successful traders enhances decision-making. Here are key methods to track the “smart money.”

1) Monitoring 13F Filings

Institutional money managers overseeing assets exceeding $100 million must submit a 13F filing to the SEC within 15 days of each quarter’s end. While individual investors may not mirror smart money trades instantly, analyzing these filings offers insights into investment rationales and the conviction behind these trades.

2) Observing Insider Purchases

Insider buying presents a valuable opportunity for investors. Notably, insider purchases carry more weight than sales, signaling confidence in potential stock price appreciation. While insider sales are often planned, insider buying typically indicates a belief in an upward stock trajectory.

Stanley Druckenmiller’s Strategic Moves in Argentina & U.S. Small Caps

Acknowledged as George Soros’s protege, Stanley Druckenmiller boasts an unparalleled three-decade track record of consistently profitable institutional investments. After a stellar performance, Druckenmiller is leveraging his insights by investing in Argentina and U.S. small-cap stocks.

Druckenmiller’s Argentina Thesis: Embracing Free Market Dynamics

Inspired by Argentinian President Javier Milei’s pro-free-market stance, Druckenmiller’s AI-driven analysis identified top Argentine ADRs for investment. Banking on a shift towards free-market policies in Argentina after years of socialism, Druckenmiller anticipates an uptrend in Argentinian stocks.

ARGT ETF: Aligning with Druckenmiller’s Vision

The ARGT ETF offers exposure to a basket of Argentine stocks for U.S. investors, echoing Druckenmiller’s bullish stance. Performing robustly compared to global counterparts, ARGT has demonstrated a 23% year-to-date increase.

Small Caps: A Return to Mean?

Venturing into call options within the Russell 2000 Index ETF (IWM), Druckenmiller is signaling a favorable outlook for U.S. small-cap stocks. Amid rising expectations of interest rate cuts in late 2024 due to subdued inflation, small caps may witness a resurgence. Charts indicate a potential technical breakout for IWM, aligning with the adage, “The longer the base, the higher in space.”

Bitcoin ETFs and Institutional Adoption

Following the approval of spot Bitcoin ETFs early this year, a wave of institutional interest in the cryptocurrency ensued. Over 600 institutions disclosed positions in Bitcoin ETFs like IBIT, signaling a shift towards mainstream adoption. Bitcoin’s trajectory is bolstered by multiple tailwinds, including the anticipated “halving” event.

Michael Burry & David Tepper: Pioneering and Accurate Moves

Renowned investors Michael Burry and David Tepper have made bold and prescient investment decisions throughout their careers. Their strategic foresight and calculated moves continue to influence market trends and investor sentiments.

Uncovering Gems: Investment Strategies in the E-Commerce Market

A Legacy of Contrarian Bets

Michael Burry and David Tepper have carved out a niche in the financial world with their bold and unconventional investment decisions. Burry’s fame skyrocketed after foreseeing and profiting from the 2008 Global Financial Crisis, a feat so impressive it earned a cinematic portrayal by Christian Bale in “The Big Short.” On the other hand, Tepper cemented his reputation by making hefty investments in major banks like Bank of America (BAC) during the crisis, accurately predicting their resilience to government intervention. His successful endeavors even led him to acquire the Carolina Panthers football team.

China and Alibaba (BABA): A Contrarian Bet

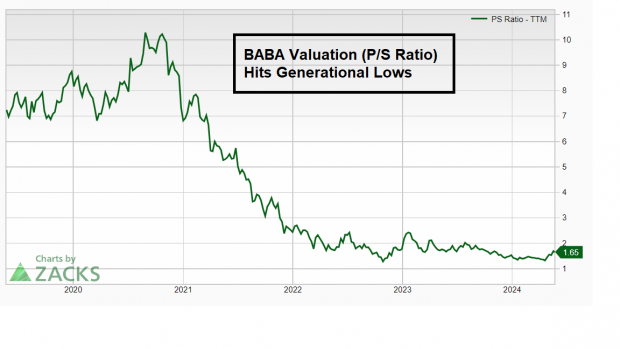

Looking towards China’s e-commerce landscape, Burry and Tepper are once again leaning into contrarian plays. Burry’s portfolio showcases a significant stake in JD.com (JD) and Alibaba (BABA), while Tepper favors Alibaba as his top open position. Noteworthy is the insider activity at Alibaba, with key figures like Founder and CEO Jack Ma demonstrating their confidence through substantial stock purchases. Despite this, the company boasts an undervalued stock price – a tantalizing prospect for value investors.

Image Source: Zacks Investment Research

The Strategic Landscape

This quarter’s 13Fs and insider transactions provide significant insights into the investment landscape favored by seasoned professionals. Markets like Argentina, small-cap stocks, Bitcoin, and China remain pivotal sectors to monitor for potential growth and opportunities. These indicators offer a glimpse into the strategies of successful investors navigating the complex financial terrain.

Conclusion

The world of finance is a stage where contrarian visions and strategic foresight meet. Burry and Tepper exemplify this duality, embracing risky yet calculated moves that often yield substantial returns. Their latest focus on the e-commerce market in China underscores their adaptability and insight into emerging trends. As investors chart their course through turbulent waters, the lessons gleaned from these masterminds can serve as guiding stars in an ever-evolving financial galaxy.