When market waters get choppy, investors often seek refuge in high-dividend-yielding stocks. These companies tend to boast substantial free cash flow and are known for generously rewarding their shareholders with hefty dividend payouts.

For insights into how leading analysts view some of the top stocks in the financial sector, investors can delve into the latest analyst evaluations on Benzinga’s Analyst Stock Ratings page. Here, traders can peruse a wealth of analyst ratings, filtered by accuracy.

Below, we explore the assessments provided by some of Wall Street’s most precise analysts on three promising high-yielding stocks in the financial services industry.

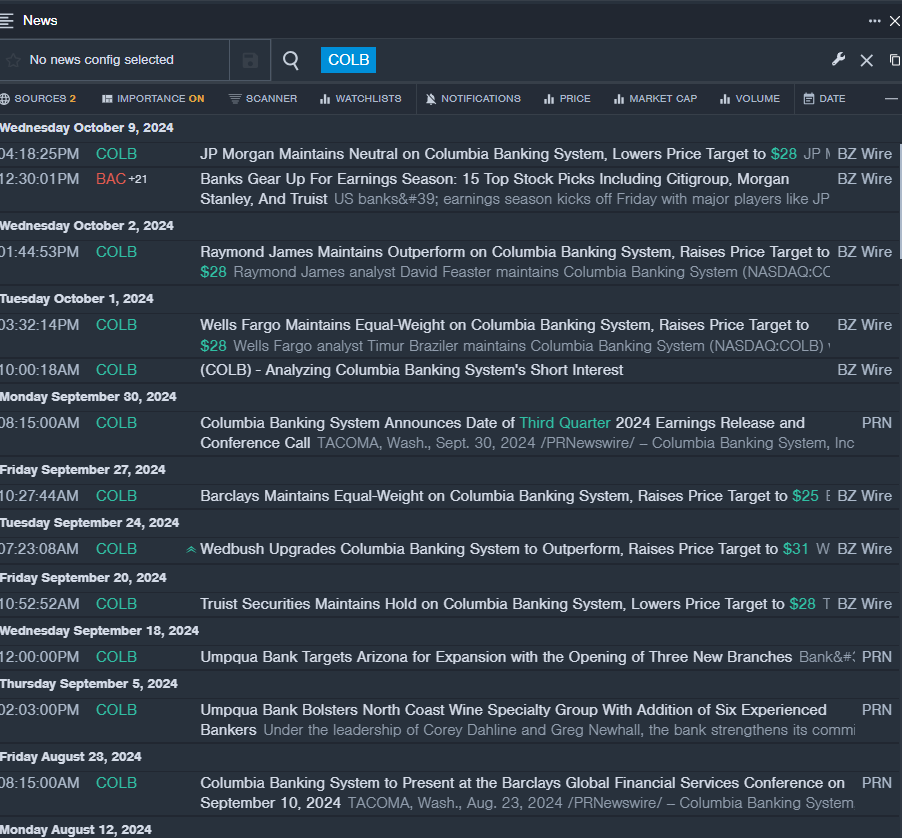

Columbia Banking System, Inc.

- Dividend Yield: 5.19%

- JP Morgan analyst Steven Alexopoulos retained a Neutral rating while reducing the price target from $29 to $28 on October 9. This analyst boasts an impressive accuracy rate of 71%.

- Raymond James analyst David Feaster upheld an Outperform rating and lifted the price target from $26 to $28 on October 2. This analyst demonstrates a commendable accuracy rate of 68%.

- Recent Development: Columbia Banking System is set to unveil its third-quarter financial results on Thursday, October 24, before the markets open.

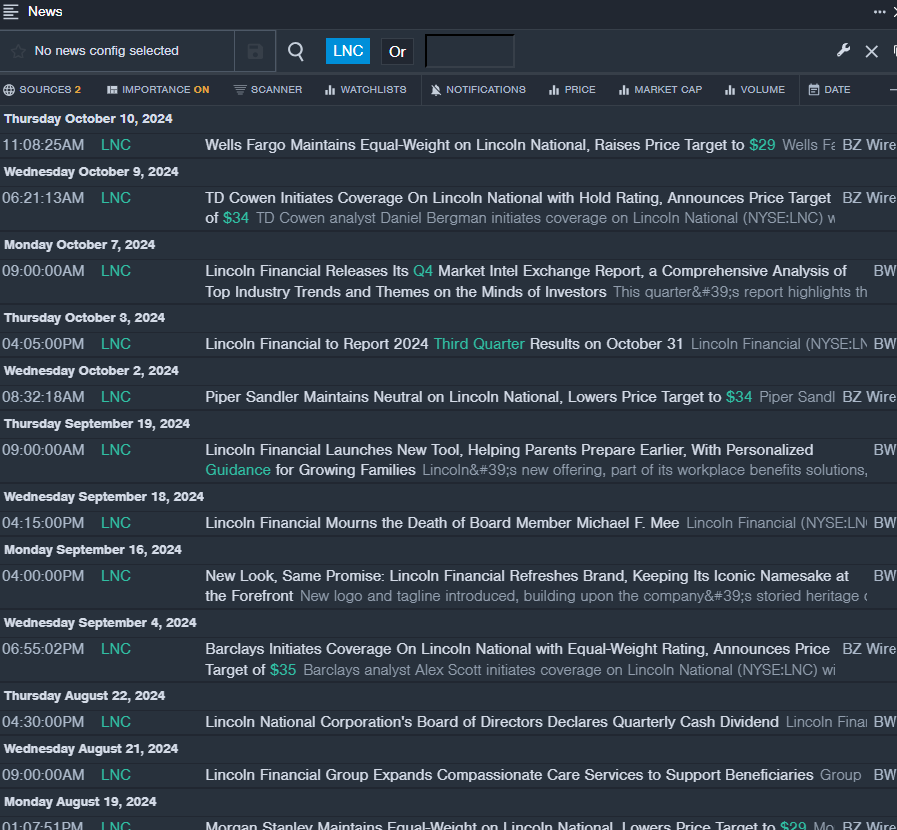

Lincoln National Corporation

- Dividend Yield: 5.35%

- Wells Fargo analyst Elyse Greenspan maintained an Equal-Weight rating and raised the price target from $28 to $29 on October 10. This analyst carries a solid accuracy rate of 68%.

- TD Cowen analyst Daniel Bergman initiated coverage on the stock with a Hold rating and a price target of $34 on October 9. This analyst demonstrates a reliable accuracy rate of 66%.

- Recent Development: Lincoln Financial is expected to announce its third-quarter results on October 31.

Main Street Capital Corporation

- Dividend Yield: 7.86%

- Morgan Stanley analyst Devin McDermott upgraded the stock from Underweight to Equal-Weight with a price target of $24 on September 16. This analyst impressively maintains an accuracy rate of 80%.

- Barclays analyst Theresa Chen sustained an Equal-Weight rating and raised the price target from $21 to $22 on September 13. This analyst upholds a commendable accuracy rate of 78%.

- Recent Development: On October 15, Main Street reported a preliminary estimate of third-quarter net investment income ranging from 99 cents to $1.01 per share.

Read More:

Market News and Data delivered by Benzinga APIs